Crypto With A Consequence

Develop a life changing Chaos resistant yield while creating jobs

and protecting the environment!

Phase I is now closed, Phase II to be announced

YOUR NATURAL HEDGE AGAINST GLOBAL FINANCIAL CHAOS

WHAT IS CHAOS?

CHAOS is the world's first true IOT-driven production, and distribution decentralized token specifically for Energy and Commodity markets that is executed entirely via Smart contracts on the blockchain.

The CHAOS chain allows production of various and diverse projects (such as Crude oil and Natural gas production, Bitcoin Mining operations, Real Estate liquidations and Digital Asset trading) to connect and post audited production on to the CHAOS token. The margins (profits) from this production is then calculated and distributed to all CHAOS holders via the built-in unique Smart Contract.

direct to the vision

Chaos RoadMap

April 2018 - Concept of a blockchain based active commodity distribution is proposed by the founders.

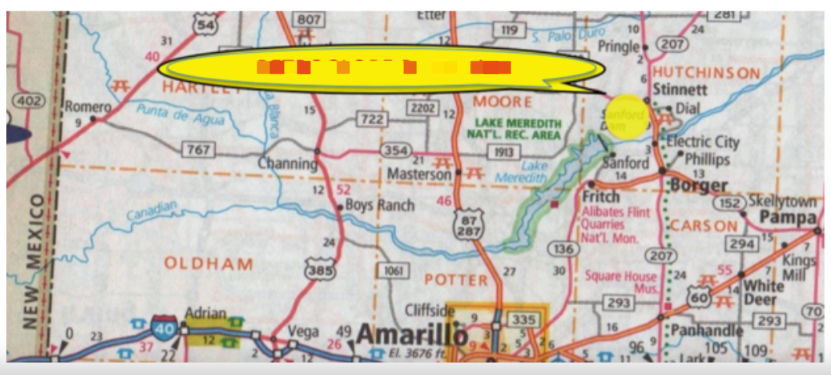

July 2018 - Founders partner with, and fund, acquisition of prototype Energy assets (Oil & Gas fields)

March 2019 - Case studies and IoT prototypes are established to confirm viability of converting production to tokenized distribution.

August 2020 - First large scale tokenization study is undertaken with $55m in assets in Energy and $30m in Commercial Estate.

Dec 2021 - Studies are concluded, and the application of tokenization production is noted as a form of Chaos Hedge against inflation.

January 2022 - CHAOS token in its current form takes shape with $100m+ in assets pledged for Phase I for CHAOS release.

March 2022 - Legal, tokenomics and yield structure are finalized for CHAOS public release.

April 2022 - Smart contract audit completed.

May 2022 - CHAOS released to public in Phase I in partnership with DART DAO.

August 2022 - Over 50% of CHAOS Phase I tokens were sold.

September 2022 - September 2022 – CHAOS Phase I closed with over 44m tokens sold.

Some statistics

Why CHAOS?

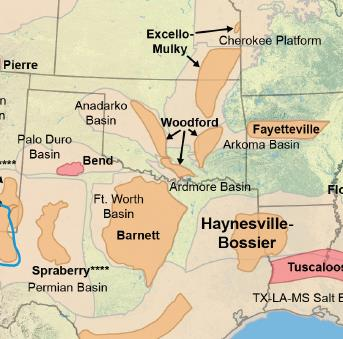

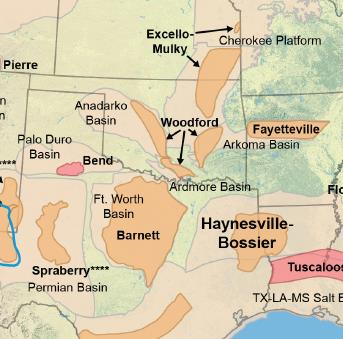

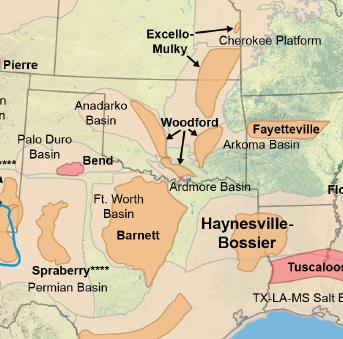

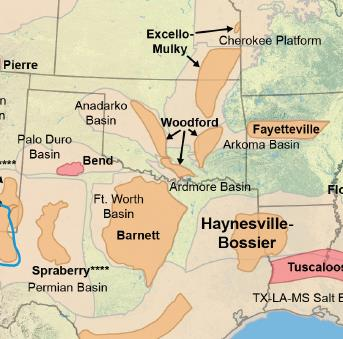

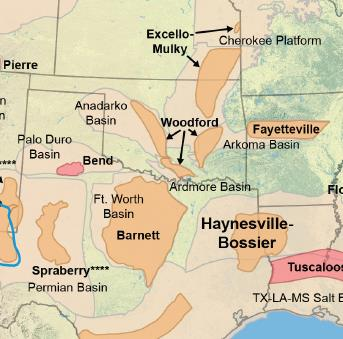

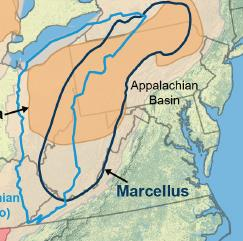

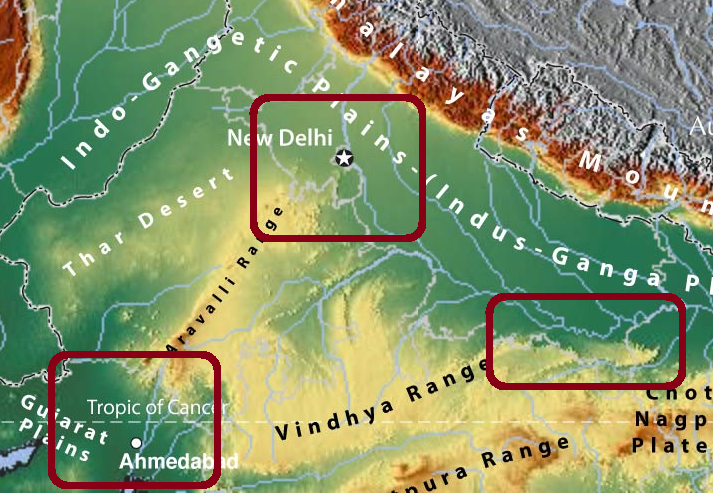

Backed up by inflation-resistant hard assets including Oil fields, Natural Gas pipelines, Bitcoin mining units, and Liquidation properties.

To ensure full transparency CHAOS is connected to Auditable Real projects to a Trackable, Safe Crypto Economy.

CHAOS receives a fixed allocation from a mix of Real Asset transactions like sale of oil fields, gas pipelines, liquidated real estate properties and Digital Asset sectors like bitcoin mining and futures trading.

With a post-release valuation target of $1.50 per token on the secondary markets, and a total supply of 750m CHAOS tokens, the market cap is expected to exceed $1b.

CHAOS Token Holders receive ongoing USDC rewards in proportion to the number of tokens held. With an APY in the range of 16% and 27% that accrues daily, and is claimable monthly.

CHAOS has already partnered with actual hard-asset holders instead of focus on just protocols and software. Resulting in a substantial Energy and Asset network prior its release.

competitors analysis

Where CHAOS stands

Expected Yield 15% to 27%

Market size $1.6-trillion

Supported by Oil, Gas, Real Estate,

Digital Assets

Expected Yield 12%

Market size $1.3-billion

Supported by BTC, ETH, LTC, XRP

Expected Yield 0% to 10%

Market size $93-trillion

Supported by stocks

Expected Yield 0.06%

Market size $7.5-trillion

Supported by Fiat currencies

About Chaos

Statistics

- Token name: CHAOS

- Ticker Symbol: CHAOS

- Starting Price Pre-ICO: 0.20

- Maximum CHAOS Produced: 750 million

- Maximum CHAOS for Sale: 350 million

- Fundraising Goal: 230 million

- Minimum Purchase: 100 CHAOS

The Decentralized Autonomous Resource Tracker Organization, or the DART DAO, is proud to announce the release of the CHAOS DeFi token. The only Energy and Commodity backed token that serves as a natural hedge against global financial Chaos.

To ensure significant appreciation for early adopters, CHAOS will be released in 3 phases with a staggered valuation structure:

Phase I – 50m tokens at $0.20 USD

Phase II – 100m tokens at $0.40 USD

Phase III – 200m tokens at $0.90 USD

With a post-release valuation target of $1.25 per token on the secondary markets. An additional 100m tokens are reserved for Operators and Managers for the various assets, 50m for the CHAOS team, 200m for locked liquidity pool, and 50m tokens allocated to bonuses and rewards. This schedule will result in total supply of 750m CHAOS with a market cap exceeding $1b post-launch.

View chaos assets